Compare car loan options by evaluating interest rates, loan terms, and fees. Ensure you check the total cost and lender reputation.

Securing the right car loan can save you money and stress. Start by comparing interest rates from various lenders. Lower rates mean less money paid over time. Next, examine loan terms. Shorter terms usually have higher monthly payments but lower total interest.

Consider any fees associated with the loan, including origination and prepayment penalties. Research the lender’s reputation through reviews and ratings. A reputable lender offers better service and reliable terms.

By carefully comparing these factors, you can find the most suitable car loan for your financial situation. Making an informed decision ensures you get the best deal and avoid unnecessary costs.

Understanding Your Needs

Before choosing a car loan, you must understand your needs. This step helps you find the best loan for your situation. Consider your budget, loan amount, and other factors.

Assessing Your Budget

Start by assessing your budget. Knowing your budget will help you pick the right loan. Here are some steps to follow:

- Calculate your monthly income.

- List all your monthly expenses.

- Subtract expenses from income to find the extra money.

Use the extra money to pay for your car loan. Make sure you leave some room for unexpected costs.

Determining Loan Amount

Next, determine the loan amount you need. This depends on the car price and your down payment. Follow these steps:

- Find the car you want to buy.

- Check its total cost.

- Decide on a down payment amount.

- Subtract the down payment from the total cost.

The result is your loan amount.

For example, if your car costs $20,000 and you pay $5,000 down, you need a $15,000 loan.

| Car Price | Down Payment | Loan Amount |

|---|---|---|

| $20,000 | $5,000 | $15,000 |

| $25,000 | $7,000 | $18,000 |

| $30,000 | $10,000 | $20,000 |

Understanding your needs is the first step in finding the right car loan. Assess your budget and determine your loan amount carefully. This will help you make a smart choice.

Credit: www.firstcitizens.com

Types Of Car Loans

Understanding the types of car loans helps you make better decisions. Knowing the differences can save you money and stress. Let’s explore the main types of car loans.

Secured Vs. Unsecured Loans

Secured loans require collateral, typically the car itself. This means the lender can take the car if you don’t pay. Secured loans usually have lower interest rates because they are less risky for lenders.

Unsecured loans do not require collateral. This means the lender cannot take the car if you don’t pay. These loans often have higher interest rates because they are riskier for lenders.

| Loan Type | Collateral Required | Interest Rates |

|---|---|---|

| Secured Loan | Yes | Lower |

| Unsecured Loan | No | Higher |

Fixed Vs. Variable Rates

Fixed-rate loans have a stable interest rate. This means your monthly payment stays the same. Fixed rates are good for budgeting because they are predictable.

Variable-rate loans have an interest rate that can change. This means your monthly payment can go up or down. Variable rates might be lower at first, but they can increase over time.

- Fixed-rate loans:

- Stable interest rate

- Predictable monthly payments

- Good for budgeting

- Variable-rate loans:

- Interest rates can change

- Monthly payments can vary

- Initial rates might be lower

Interest Rates And Apr

When comparing car loan options, understanding interest rates and APR is crucial. These terms affect your monthly payments and the total cost of the loan. This section will help you grasp how interest rates and APR work, and why they are important.

How Interest Rates Work

Interest rates determine the cost of borrowing money. They are expressed as a percentage of the loan amount.

For example, a 5% interest rate on a $10,000 loan means you pay $500 annually in interest.

Interest rates can be fixed or variable. Fixed rates stay the same throughout the loan term. Variable rates can change over time, affecting your monthly payments.

It’s essential to compare interest rates from different lenders. Even a small difference can save you a lot of money over the loan term.

Importance Of Apr

APR stands for Annual Percentage Rate. It includes the interest rate and other loan costs.

APR gives a more accurate picture of the loan’s total cost. Unlike interest rates, APR includes fees like origination fees and closing costs.

When comparing loans, look at the APR instead of just the interest rate. A lower APR means a cheaper loan overall.

Here’s a table to help you understand the difference:

| Loan Amount | Interest Rate | APR | Monthly Payment |

|---|---|---|---|

| $10,000 | 5% | 5.5% | $193 |

| $10,000 | 4.5% | 5% | $188 |

In the table, the second loan has a lower monthly payment. This is because its APR is lower, even though the interest rate is also lower.

Understanding these terms can help you choose the best car loan. This will save you money and make your payments more manageable.

.jpg)

Credit: www.cs.bank

Loan Terms And Conditions

Understanding the loan terms and conditions is crucial. It helps you choose the best car loan option. Different lenders offer varied terms. These can affect your monthly payments and the total cost.

Loan Duration

The loan duration is the length of time you have to repay the loan. Common durations are:

- 36 months

- 48 months

- 60 months

- 72 months

A longer duration means lower monthly payments. But, you may pay more in interest. A shorter duration has higher monthly payments. Yet, you pay less in interest over time. Choose a duration that fits your budget and financial goals.

Prepayment Penalties

Some loans have prepayment penalties. These are fees for paying off your loan early. Not all lenders charge these fees. Check the loan agreement for any prepayment penalties. Avoid these penalties to save money. If possible, choose a loan without prepayment penalties.

| Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|

| 36 months | $600 | $1,800 |

| 48 months | $450 | $2,400 |

| 60 months | $350 | $3,000 |

| 72 months | $300 | $3,600 |

Use this table to see how loan duration affects payments and interest. It helps you make an informed decision.

Credit Score Impact

Your credit score plays a vital role in car loans. It affects the interest rate and loan terms you can get. A higher score means better loan options and lower interest rates. Here’s a detailed look into how your credit score impacts car loans.

Role Of Credit Score

Credit scores range from 300 to 850. Lenders use these scores to judge your creditworthiness. A higher score shows you manage credit well. It means you pay your bills on time. Lenders trust you more, offering better loan deals.

Below is a table that shows how different credit score ranges can impact your car loan options:

| Credit Score Range | Impact on Car Loan |

|---|---|

| 750 – 850 | Excellent: Best interest rates |

| 700 – 749 | Good: Good interest rates |

| 650 – 699 | Fair: Average interest rates |

| 600 – 649 | Poor: Higher interest rates |

| 300 – 599 | Very Poor: Highest interest rates |

Improving Your Credit Score

Improving your credit score can lead to better car loan options. Here are some simple steps:

- Pay bills on time: Late payments hurt your score.

- Reduce debt: Lowering debt improves your score.

- Check your credit report: Fix any errors you find.

- Limit new credit: Too many new accounts can lower your score.

Following these steps can make a big difference. A better credit score means better car loan offers.

Credit: en.comparis.ch

Comparing Lenders

Comparing lenders is essential when selecting a car loan. Different lenders offer different terms, rates, and benefits. Understanding the differences helps you make an informed decision.

Banks And Credit Unions

Banks and credit unions are traditional lenders. They often provide competitive car loan options. Here are some key points to consider:

- Interest Rates: Banks may offer lower rates for existing customers. Credit unions often have lower rates than banks.

- Loan Terms: Both offer a variety of loan terms. Shorter terms usually have lower interest rates.

- Customer Service: Banks have extensive customer service networks. Credit unions provide personalized service to their members.

- Eligibility: Banks may have stricter eligibility criteria. Credit unions often have more flexible requirements.

Here is a comparison table for quick reference:

| Feature | Banks | Credit Unions |

|---|---|---|

| Interest Rates | Lower for existing customers | Generally lower than banks |

| Loan Terms | Variety of options | Flexible options |

| Customer Service | Extensive network | Personalized service |

| Eligibility | Stricter criteria | More flexible |

Online Lenders

Online lenders are a modern option for car loans. They offer convenience and often competitive rates. Consider these aspects:

- Interest Rates: Online lenders may offer lower rates due to lower overhead costs.

- Application Process: The process is often quick and fully online. Approval can be faster than traditional lenders.

- Flexibility: Online lenders may offer more flexible terms. They cater to various credit profiles.

- Customer Support: Customer support is usually available via chat or email. Some may lack in-person support.

Here is a comparison table for quick reference:

| Feature | Online Lenders |

|---|---|

| Interest Rates | Often lower due to low overhead |

| Application Process | Quick and fully online |

| Flexibility | More flexible terms |

| Customer Support | Available via chat or email |

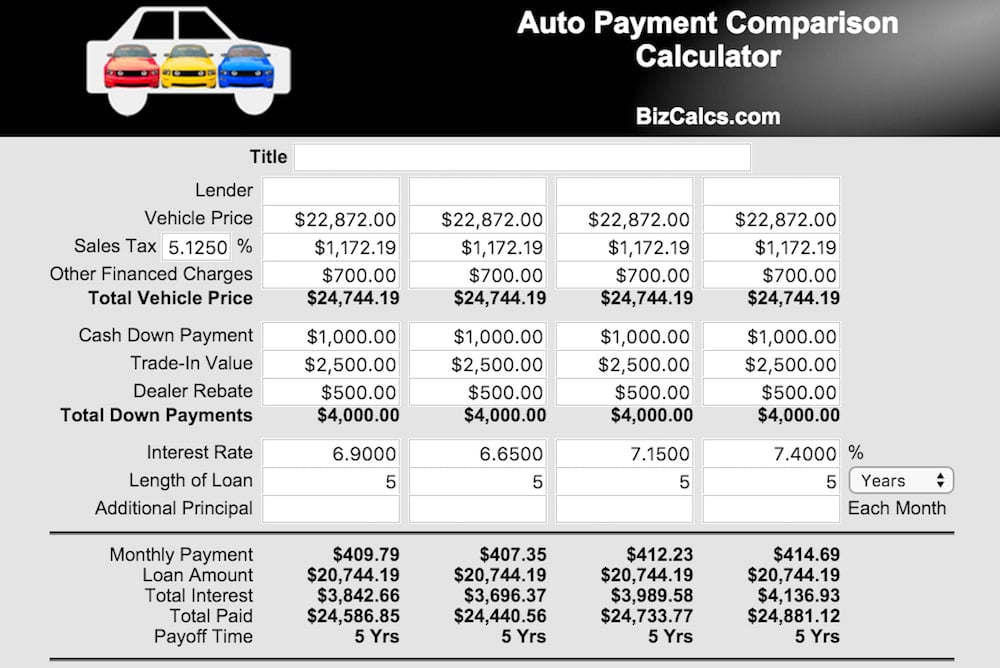

Using Loan Calculators

Comparing car loan options can be a daunting task. Using a loan calculator simplifies the process. It helps you understand your monthly payments, interest rates, and total loan costs. This tool is essential for making informed financial decisions.

Benefits Of Loan Calculators

Loan calculators offer several benefits that make them indispensable:

- Accurate Estimates: They provide accurate monthly payment estimates.

- Time-Saving: Quickly compare different loan options.

- Financial Planning: Helps in planning your budget effectively.

- Interest Insights: Understand the impact of different interest rates.

These benefits help you choose the best loan option without hassle.

How To Use Them Effectively

Follow these steps to use loan calculators effectively:

- Gather all necessary information like loan amount, term, and interest rate.

- Input these details into the calculator fields.

- Review the results carefully. Check monthly payments and total loan cost.

- Adjust the loan amount and term to see different scenarios.

Using these steps ensures you get the most accurate results. Compare various options to find the best deal for your needs.

| Loan Term | Interest Rate | Monthly Payment | Total Loan Cost |

|---|---|---|---|

| 36 months | 3.5% | $300 | $10,800 |

| 48 months | 4.0% | $230 | $11,040 |

| 60 months | 4.5% | $190 | $11,400 |

This table illustrates how different loan terms and interest rates affect payments and costs. Use this information to make a well-informed decision.

Reading The Fine Print

Understanding the fine print is crucial when comparing car loan options. It can save you from unexpected costs and terms that might not be in your favor. This section will help you navigate through the fine print.

Hidden Fees

Car loan agreements often come with hidden fees. These fees can increase the overall cost of the loan. Here are some common hidden fees to watch out for:

- Origination Fees: Charged for processing the loan application.

- Prepayment Penalties: Fees for paying off the loan early.

- Late Payment Fees: Penalties for missing payment deadlines.

- Documentation Fees: Costs for paperwork and administrative tasks.

Knowing about these fees in advance can help you make an informed decision. Always ask the lender to clarify any fee you don’t understand.

Understanding Terms

Loan terms define the rules and conditions of the loan. Understanding these terms is essential for managing your car loan effectively.

| Term | Meaning |

|---|---|

| Interest Rate: | The percentage charged on the loan amount. |

| Loan Tenure: | The period over which the loan must be repaid. |

| Principal Amount: | The original amount of money borrowed. |

| Monthly Installment: | The amount to be paid every month. |

Make sure you fully understand each term before signing the loan agreement. Ask questions if anything is unclear to you.

By carefully reading the fine print, you can avoid surprises and ensure that the car loan you choose is the best fit for your needs.

Making The Final Decision

Choosing a car loan requires careful thought. This section helps you make the final decision. We will focus on weighing your options and choosing the best deal.

Weighing Your Options

Begin by listing all car loan offers. Create a simple table to compare key features:

| Loan Provider | Interest Rate | Loan Term | Monthly Payment |

|---|---|---|---|

| Bank A | 3.5% | 5 years | $350 |

| Credit Union B | 3.0% | 4 years | $400 |

| Online Lender C | 4.0% | 6 years | $300 |

Examine each offer for hidden fees. Look at the total cost of the loan. Consider the interest rate and monthly payment. Think about the loan term and how it fits your budget.

Choosing The Best Deal

Now, pick the best deal based on your comparison. Follow these steps:

- Identify the lowest interest rate.

- Check if the monthly payment fits your budget.

- Ensure the loan term is reasonable.

- Look for any hidden fees or penalties.

Use a loan calculator to estimate total costs. This helps you see the long-term financial impact. Finally, trust your judgment and choose the loan that feels right. Remember, the best deal is one that balances cost and convenience.

Frequently Asked Questions

What Factors Affect Car Loan Interest Rates?

Interest rates depend on credit score, loan term, and down payment. Compare multiple lenders to find the best rate.

How To Calculate Monthly Car Loan Payments?

Use online calculators. Input loan amount, interest rate, and term to estimate monthly payments.

Can You Refinance A Car Loan?

Yes, refinancing can lower interest rates or monthly payments. Check your credit and compare offers.

What Is The Best Loan Term For A Car?

Shorter terms usually offer lower interest rates but higher monthly payments. Choose based on your budget and goals.

How Does A Down Payment Affect A Car Loan?

A larger down payment reduces the loan amount and monthly payments. It may also lower interest rates.

Is It Better To Lease Or Finance A Car?

Leasing offers lower monthly payments but no ownership. Financing builds equity but may have higher payments. Choose based on your needs.

Conclusion

Comparing car loan options is essential for securing the best deal. Evaluate interest rates, terms, and fees thoroughly. Consider your budget and financial goals. Make an informed decision to save money and reduce stress. Research and compare to find the perfect car loan that fits your needs.