To negotiate with a car dealer, research the car’s market value and set a firm budget. Be polite but assertive during discussions.

Buying a car can be both exciting and stressful. Negotiating effectively ensures you get the best deal. Start by researching the car’s market value and understanding its features. This knowledge empowers you during negotiations. Set a clear budget and stick to it.

Engage the dealer with confidence and be prepared to walk away if necessary. Be polite, but assertive, ensuring your needs are met. Building a rapport with the dealer can also help in getting favorable terms. Practice patience and don’t rush the process. A well-negotiated deal can save you significant money and ensure a satisfying purchase experience.

Research And Preparation

Negotiating with a car dealer requires solid research and thorough preparation. Having the right information can give you confidence and leverage. Let’s dive into the two most crucial aspects of research and preparation.

Know The Market Value

Understanding the market value of the car is essential. This helps you know if the dealer’s price is fair.

Use online tools and websites to find the average price. Websites like Kelley Blue Book and Edmunds can help.

| Website | Features |

|---|---|

| Kelley Blue Book | Price range, customer reviews, car specifications |

| Edmunds | True Market Value, expert reviews, car features |

Compare prices from these websites. Make sure you know the prices for the car’s make, model, and year.

Check Dealer Reviews

Before visiting any dealer, check their reviews online. Reviews help you understand the dealer’s reputation.

Look for reviews on Google, Yelp, and the Better Business Bureau. Pay attention to how they treat customers and handle complaints.

- Google Reviews: Look for ratings and customer feedback.

- Yelp: Read detailed experiences from past customers.

- Better Business Bureau: Check for any complaints filed against the dealer.

Choose dealers with good ratings and positive reviews. Avoid dealers with lots of complaints or negative feedback.

Credit: www.creditkarma.com

Setting A Budget

Before you step into a car dealership, setting a budget is crucial. It helps you stay focused and avoid overspending. Knowing your budget helps you negotiate better deals. Let’s dive into how to set a solid budget for your car purchase.

Determine Your Maximum Price

Your maximum price is the highest amount you can spend. Think about how much you can afford monthly. Multiply this by the number of months in your loan term. This gives you an idea of your maximum price.

Use the table below to calculate your maximum price:

| Monthly Budget | Loan Term (Months) | Maximum Price |

|---|---|---|

| $300 | 60 | $18,000 |

| $400 | 60 | $24,000 |

| $500 | 60 | $30,000 |

Stick to your maximum price to avoid financial strain. Always remember, your budget is your guide.

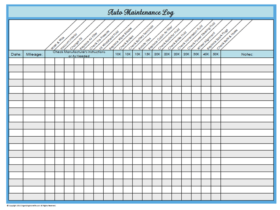

Consider Additional Costs

Buying a car involves more than just the sticker price. You must consider additional costs. Here are some extra costs to keep in mind:

- Insurance

- Maintenance

- Registration fees

- Taxes

- Fuel

Factor these into your budget to avoid surprises. These costs can add up quickly. Ensure you can afford the total monthly outlay.

Here is a simple way to estimate your total monthly cost:

- Calculate your monthly car payment.

- Add estimated monthly insurance costs.

- Add average monthly fuel costs.

- Include a buffer for maintenance and other fees.

By setting a realistic budget, you can make a smart purchase. A clear budget leads to better negotiation outcomes.

Timing Your Purchase

Timing your purchase can greatly impact the price you pay for a car. Knowing the best times to buy and when seasonal deals are available can save you a lot of money. Below, we will explore the best times to buy and how to take advantage of seasonal deals.

Best Times To Buy

The end of the month is a great time to buy. Dealers have quotas to meet. They are more likely to offer discounts to reach their goals.

Buying at the end of the year is also wise. Dealerships want to clear out old inventory. Look for deals in December, as they make room for new models.

The middle of the week is another good time. Fewer customers visit dealerships on Tuesday or Wednesday. Salespeople may give you more attention and better deals.

Seasonal Deals

Holiday sales events offer great opportunities. Look for deals around Memorial Day, Fourth of July, and Labor Day. These holidays often come with significant discounts.

End-of-season sales are also valuable. Dealers want to sell summer cars before winter. Look for deals on convertibles and sports cars in the fall.

Winter sales events can offer great savings. Dealers want to sell trucks and SUVs before spring. Check for deals on these vehicles during the winter months.

| Best Time | Reason |

|---|---|

| End of the Month | Dealers meet quotas |

| End of the Year | Clear out old inventory |

| Middle of the Week | Fewer customers |

- Holiday Sales: Memorial Day, Fourth of July, Labor Day

- End-of-Season Sales: Fall for summer cars

- Winter Sales: Trucks and SUVs

By timing your purchase right, you can negotiate better deals and save money.

Credit: www.cars.com

Negotiation Tactics

Negotiating with a car dealer can be challenging. But with the right tactics, you can get a great deal. Here are some effective strategies to use during your negotiation process.

Start With A Low Offer

Always begin with a low offer. This gives you room to negotiate. Dealers often expect buyers to start low. This tactic lets you gauge their flexibility. If the dealer counters, you can gradually increase your offer. Ensure your initial offer is realistic. A very low offer might offend the dealer.

Be Ready To Walk Away

Never show desperation. Be ready to walk away from the deal. This shows the dealer you have other options. Often, dealers will lower the price to keep you. Walking away can be a powerful negotiation tool. Ensure you have researched other dealerships. This gives you confidence to walk away if needed.

Handling Trade-ins

Handling trade-ins can greatly impact your car purchase deal. Understanding the process helps you get the best value for your old car. Here are some tips to guide you through handling trade-ins effectively.

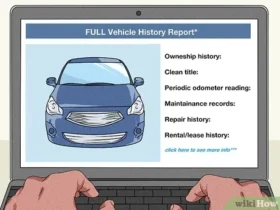

Value Your Trade-in

Before visiting the dealership, know the value of your trade-in. Use online tools like Kelley Blue Book or Edmunds to get an estimate. These tools give you a fair market value based on your car’s condition, mileage, and model year.

Here is a simple table to compare different tools:

| Tool | Website |

|---|---|

| Kelley Blue Book | kbb.com |

| Edmunds | edmunds.com |

Gather multiple estimates to ensure you have a clear picture. Bring these estimates to the dealership as a reference.

Separate Trade-in Negotiation

Negotiate your trade-in separately from your new car purchase. This ensures you get the best deal for each part of the transaction.

Follow these steps:

- First, agree on the price of the new car.

- Next, discuss the value of your trade-in.

Dealers may try to combine these negotiations to confuse you. Stay firm and keep the transactions separate. This helps you see the true value of each part of the deal.

Use these tips to handle trade-ins effectively and get the best value for your old car.

Financing Options

Negotiating with a car dealer can be challenging. One crucial aspect is the financing options. Understanding your choices can save you money. Below, we discuss two primary financing options: pre-approved loans and dealer financing.

Pre-approved Loans

Before visiting the dealership, get a pre-approved loan. This helps you know your budget. Here are some benefits of pre-approved loans:

- Better interest rates

- Set budget limits

- Enhanced negotiation power

Visit banks and credit unions to compare rates. Use online tools to find the best offers. Pre-approved loans can make the car-buying process smoother.

Dealer Financing

Dealer financing is another option. Dealers offer in-house financing. Here are some benefits:

- Convenient one-stop shopping

- Potential promotional rates

- Special dealer incentives

Always compare dealer rates with pre-approved loans. This ensures you get the best deal. Use the table below to see the differences:

| Feature | Pre-Approved Loans | Dealer Financing |

|---|---|---|

| Interest Rates | Usually lower | May vary |

| Convenience | Requires pre-visit work | One-stop |

| Negotiation Power | Higher | Depends on dealer |

Both options have pros and cons. Choose the one that suits your needs. Always read the fine print. Know all terms before signing any agreement.

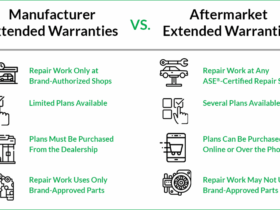

Credit: www.endurancewarranty.com

Reviewing The Contract

Reviewing the contract is a crucial step in negotiating with a car dealer. Ensuring you understand the details can save you from unexpected costs and terms. Here are some key aspects to focus on:

Check For Hidden Fees

Before signing, always check for hidden fees. These can include:

- Documentation Fees

- Dealer Preparation Fees

- Advertising Fees

These fees can inflate the total cost. Ask the dealer to explain any fees you don’t understand. Negotiate to remove unnecessary charges.

Understand The Terms

Understanding the terms of the contract is essential. Look for the following:

- Interest Rates: Ensure you get the best rate possible.

- Loan Duration: Shorter terms often mean higher monthly payments.

- Warranty Details: Know what is covered and for how long.

Also, pay attention to any penalties for early repayment. Make sure the terms are clear and fair. If you have questions, ask the dealer to clarify.

Finalizing The Deal

Finalizing the deal is the most exciting part of buying a car. This is where you ensure all the details are in place. You will sign the necessary paperwork and make your payment. Let’s break down the steps to close the deal and celebrate your purchase.

Close The Deal

Ensure you review all the paperwork carefully. Double-check the figures in the contract. Look for any hidden fees or extra charges. Ask questions if something seems unclear. Confirm the agreed price is correct. Make sure the warranty details are included. Validate the terms of any financing agreements.

| Checklist | Description |

|---|---|

| Review Contract | Check for accuracy and hidden fees. |

| Confirm Price | Ensure the agreed price is listed. |

| Warranty Details | Verify warranty information is correct. |

| Financing Terms | Validate the terms of any loans. |

Pay attention to every detail. This ensures there are no surprises. Once satisfied, sign the documents. Keep copies for your records. Make your payment. Confirm the payment method with the dealer. This might be a check, bank transfer, or financing.

Celebrate Your Purchase

After signing, take a moment to celebrate. You have successfully negotiated and finalized your car purchase. Take a picture with your new car. Share it with friends and family. Enjoy the moment!

- Take a picture with your new car.

- Share the news with your loved ones.

- Go for a celebratory drive.

Enjoy the feeling of accomplishment. You navigated the negotiation process. Now, it’s time to drive your new car.

Frequently Asked Questions

How To Prepare For Car Negotiation?

Research car prices online. Know the market value of the car you want.

What To Ask A Car Dealer?

Ask about the car’s price, financing options, and any available discounts or incentives.

Can I Negotiate Car Price Online?

Yes, many dealers are open to online price negotiations. Use email or chat for initial discussions.

How To Get The Best Car Deal?

Compare offers from multiple dealerships. Leverage competing quotes to get the best price.

Should I Trade In My Old Car?

Trading in your old car can lower your new car’s cost. Get multiple trade-in quotes for the best deal.

What Are Common Negotiation Tactics?

Be polite but firm. Know your budget and stick to it. Don’t be afraid to walk away.

Conclusion

Mastering car dealer negotiations can save you money and stress. Remember to research, stay confident, and be patient. Practice these strategies to secure the best deal. Your efforts will pay off with a favorable price. Happy car shopping and smart negotiating!

Leave a Reply